8666201302: Key Factors for Picking Profitable Stocks

The process of selecting profitable stocks requires a systematic approach that encompasses various analytical dimensions. Investors must scrutinize market trends, evaluate company fundamentals, and assess their own risk tolerance. Each factor plays a pivotal role in shaping investment outcomes. Understanding these elements can significantly influence decision-making. Yet, the interplay between them remains complex and warrants further exploration to maximize investment potential. What specific strategies can be employed to navigate this intricate landscape?

Understanding Market Trends

How do market trends influence investment decisions?

Market cycles play a critical role in shaping investor sentiment, as fluctuations in economic conditions often dictate risk tolerance.

During bullish phases, optimism can drive investments, while bearish trends may foster caution.

Understanding these dynamics allows investors to make informed decisions, aligning their strategies with prevailing market conditions and potentially enhancing their financial freedom through calculated risks.

Analyzing Company Fundamentals

Analyzing company fundamentals is essential for investors seeking to make informed decisions in the stock market.

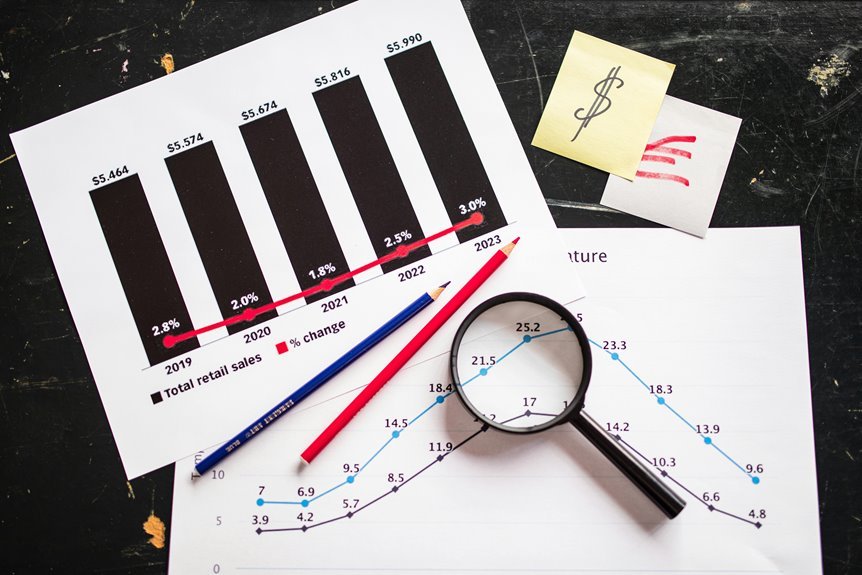

Key components include scrutinizing financial ratios, which provide insights into a company’s profitability, liquidity, and efficiency. Additionally, assessing earnings growth reveals a firm’s potential for future performance.

Together, these metrics empower investors to identify strong candidates for investment, fostering a strategy aligned with financial freedom.

Evaluating Risk and Reward

Evaluating risk and reward is a critical aspect of investment strategy that demands careful consideration.

Investors must assess their risk tolerance to determine suitable stock choices. Portfolio diversification serves as a vital tool in mitigating potential losses while aiming for gains.

A balanced approach enables investors to navigate market fluctuations, optimizing returns without exposing themselves excessively to volatility or unforeseen market changes.

Conclusion

In conclusion, selecting profitable stocks requires a multifaceted approach that integrates an understanding of market trends, thorough analysis of company fundamentals, and careful evaluation of risk and reward. Notably, research indicates that companies with consistent earnings growth outperform the market by approximately 15% annually. This statistic underscores the importance of focusing on financial stability and operational efficiency, reinforcing the notion that informed decision-making is vital for achieving long-term financial success in the stock market.